New Stock Research Website Released | The Simple Side

Description

Thanks to Avalara for sponsoring today’s article!

Quick Reminders:

* Our disclosure is in the email footer

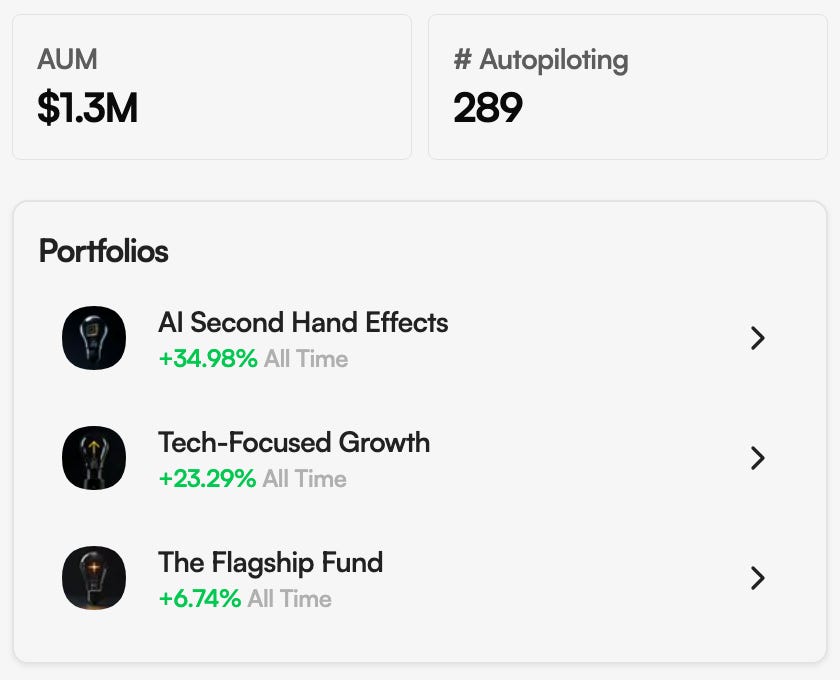

* Portfolio copy trading is available here

* You can find our podcast on YouTube, Spotify, Apple Music, and here on Substack!

* You can get daily market news from: The Simple Side Daily newsletter.

* Use this button to leave me comments about what you want to see in the newsletter.

FIND ALL OF OUR STOCK RESEARCH ARTICLES HERE: LINK

Our goal is to be the most transparent, open & honest finance newsletter out there. All of our researched stocks (good and bad). Will be published here after the article is written!

Portfolio Overextended & Oversold Positions

Market Wisdom

I call investing the greatest business in the world because you never have to swing. You stand at the plate, the pitcher throws you General Motors at 47! U.S. Steel at 39! and nobody calls a strike on you. There’s no penalty except opportunity lost. All day you wait for the pitch you like, then when the fielders are asleep, you step up and hit it.”- Warren Buffet

I think Buffett gets quoted and used as a headline far too often in the finance world, but can you blame anyone? He is the Michael Jordan of the finance world, or maybe Michael Jordan is the Warren Buffett of the basketball world… either way, his advice still rings true today.

Today’s market wisdom quote is so important in the investment environment. There is so much fear & green being thrown at us as investors all the time. I can’t go more than a few minutes without seeing a post about the bubble. Here is the bad news: you can’t avoid a bubble unless you want to put $0 in equities. Here is the good news: you aren’t required to put all your money in equities! We here at The Simple Side are 50% in cash right now, just waiting for good opportunities to come across our radar.

Needless to say, relax. Take a breath, go for a walk, ignore the media for a bit. If you are stressed about your portfolio, take some chips off the table! If you think you’re missing out on returns, throw some chips on the table!

Remember, if you have cash on the sidelines, you can stand at the plate for weeks, months, years, and you’ll never be called out.

Okay, let’s get into the news!

Weekly Roundup

Stocks climbed to fresh records, powered (again) by mega-cap tech. The S&P 500, Nasdaq, and Dow all finished higher, but breadth stayed narrow: the market-cap indexes outpaced the equal-weight S&P, which tells you the biggest names did most of the lifting. That narrow leadership matters because it makes the tape look strong even when many stocks are just okay.

Here is something a lot of people don’t understand when it comes to investing & it will be beneficial for you to see.

What you are looking at is a graph of the median returns of each sector compared to the S&P 500. Tell me what you notice…

If you are wondering how the S&P 500 was up this week and the median returns across all sectors was negative, DING DING DING.

This shows the current intense concentration that the indexes have on mega-cap companies. The big takeaway here is 2 fold

* Investing in the index is becoming an increasingly risky proposition and will begin to underperform in the coming years.

* If and when mega-caps start to underperfrom it will bring the whole market down with it. This is bad for those who think the SPY is safe, but good for people like us with cash on the sidelines!

The Fed cut 25 bps but warned the next cut isn’t guaranteed. The 10-year hovered near ~4%. Lower/steady long rates boost the value of future earnings, which favors growth and AI leaders. Volatility stayed contained in the mid-teens, a sign dip-buyers remain confident.

The market is still experiencing an incredible “buying pace” — aka, people still cannot get enough of equities, so everything seems to remain “bullish” for equity investors (at least through the next few months).

AI spending kept showing up in hard numbers.

Nvidia pushed to new highs, guided to enormous chip orders into 2026, and extended partnerships from data centers to networking. Microsoft and Alphabet reported strong cloud/AI demand. Meta also grew, but its bigger-than-expected AI capex spooked investors. Useful reminder: the winners of this build-out (chips, racks, power, cooling, interconnects) can rally even when platform owners debate the payback timeline.

Earnings flow backed the rally.

Amazon beat with an AWS re-acceleration and raised capex for AI. Apple beat and guided to record holiday sales. Industrial and travel names posted solid prints (Honeywell, Las Vegas Sands), while a few payments and software names disappointed (Fiserv reset guidance). The “soft-landing + AI investment” narrative is still intact, but stock-by-stock results matter.

Commodities were friendly for risk assets.

Oil hovered around ~$60 — a low price for this cycle that eases costs for consumers, transports, and manufacturers (but pressures energy producers unless margins/volumes offset). Gold near ~$4,000 stayed elevated. High gold while stocks rise basically says: investors are willing to take risk, but they’re also hedging against policy/geopolitical surprises.

This is something we have seen for weeks now, clearly, not everyone behind the scenes is 100% confident that the current market run can go on forever.

Policy and trade headlines lowered tail risk.

Washington and Beijing stepped back from fresh escalation and paused new rare-earth export curbs for a year. That reduces near-term supply anxiety for chip and EV supply chains, even if existing controls and scrutiny remain.

Amazon announced deeper headcount cuts to streamline layers and steer more dollars to AI. On the deal front, Novartis’ buyout of Avidity lit up small-cap biotech, banks combined to gain scale (Huntington–Cadence), and two major water utilities agreed to merge — evidence of ongoing consolidation across sectors.

Crypto was a sideshow: Bitcoin drifted around the low-$100K mark. Institutions keep normalizing the asset class, yet flows remain choppy. It’s acting more like a risk asset than an inflation hedge week-to-week.

We keep track of all of these trades on our Google sheet (available to paid subs), and then insider returns are quite astounding… (I have been removing quite a few of the penny stocks/ super risky investments to make the returns more normalized.)

The current insider buy/sell ratio is sitting at 0.22, which is relatively low. Over the past 5 years, I have seen the average go as high as 0.81 in May of 2022 (a strong buying signal), and as low as 0.17 (a sell/hold signal).

Whale Buys

Oct 30, 2025

* MLPT — MapLight Therapeutics, Inc. · 10% Owner · 5,441,176 @ $17.00 ($92.50M) · holdings +38.17%.

* NVCT — Nuvectis Pharma, Inc. · 10% Owner · 154,770 @ $6.18 ($957.08K) · holdings +5.01%.

* IRDM — Iridium Communications Inc. · Director · 30,000 @ $17.49 ($524.70K) · holdings +11.22%.

Oct 29, 2025

* KMI — Kinder Morgan, Inc. · Executive Chairman · 1,000,000 @ $25.96 ($25.96M) · holdings +0.39%.

* ASA — ASA Gold & Precious Metals Ltd · 10% Owner · 28,500 @ $44.08 ($1.26M) · holdings +0.56%.

* EBC — Eastern Bankshares, Inc. · Executive Chair · 50,000 @ $17.21 ($860.50K) · holdings +13.99%.

* NSC — Norfolk Southern Corp · Director · 2,600 @ $281.86 ($732.82K) · holdings +59.09%.

* BWB — Bridgewater Bancshares Inc · Director · 30,000 @ $17.45 ($523.54K) · holdings +3,409.09%.

Oct 28, 2025

* SMMT — Summit Therapeutics Inc. · Director · 533,617 @ $18.74 ($10.00M) · holdings +1.69%.

* V